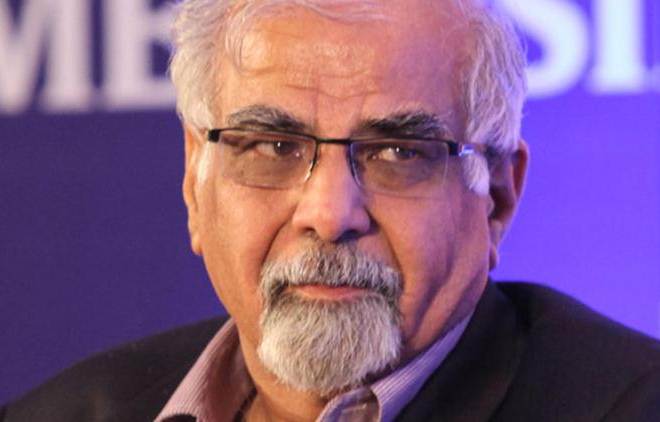

Surjit Bhalla, the prominent market analyst who was selected as an individual from Prime Minister Narendra Modi’s recently framed Economic Advisory Council, has a solitary direct recommendation toward restore the monetary development.

- Surjit Bhalla, the prominent business analyst who was delegated as an individual from Prime Minister Narendra Modi’s recently shaped Economic Advisory Council, has a solitary guide proposal toward resuscitate the financial development and bring it recovered. In any case, that recommendation is not for the Prime Minister or the Finance Minister; it is for the Reserve Bank of India, ie, cut arrangement rates by 100 premise focuses. Surjit Bhalla contends that the main response to a moderate economy is low-loan fees

- It was being expected that the administration on Monday would declare something along the lines of a supporter dosage to help the sickly economy. Be that as it may, the legislature rather shaped the EAC, and reported Saubhagya Yojana to give power to all family units. With the administration not setting up forward any financial strategy to settle the economy, the examiners say the onus has now moved to the Reserve Bank of India to do its part when it sits for the bi-month to month approach survey one week from now.

- Surjit Bhalla has pushed reducing of the moderate monetary development — low GDP, high expansion, value markets at a month’s low, rupee going down, et al. He as of late showed how every 100 bps increment in the key approach rates in one-year in the end causes diminish in monetary development by 40 bps. “In many nations (strike that, and supplant with “all nations aside from an extraordinary nation called India”), the above inquiry has a similar answer — take a gander at financing costs, imbecilic. Regardless of what nation, national banks and government authorities have a similar answer and a similar approach: To build request (up the GDP development rate), diminish loan costs; to diminish request, increment loan costs,” Surjit Bhalla wrote in an emphatic segment in the Financial Express a week ago.

Reserve Bank Of India

Be that as it may, the RBI is very far-fetched to cut the rates for the time being since it has little room from the perspective of expansion, which as of late began creeping up, DBS Research said in a note toward the beginning of today. “The feature expansion may settle inside 3.8%-4.5% territory for rest of FY18, around RBI’s 4% target,” DBS said in the note.

Further, the financial boost could in the long run wind up enlarging the monetary shortage, leaving RBI with much lesser space to cut rates, DBS Research said in the note. “Hypothesis that financial solidification may be deferred or that FY18 deficiency focus of 3.2% of GDP may be broken, will just leave the RBI more careful than earlier,” it said.

RBI, in its last approach survey in August, lessened the repo rate by 0.25% to 6%, refering to decrease in swelling dangers. The rate cut was the first in 10 months and conveyed strategy rates to a close to 7-year low. Around the same time, the retail expansion rose to a five-month high of 3.36% because of higher costs of vegetables and organic product yet at the same time stay beneath RBI’s 4% target.

Source:financialexpress.com